1099-NEC: When You Should & Shouldn’t Be Filing

This post may have affiliate links. Please read the Disclosure Policy for complete details.

This is a prequel to an article about receiving Form 1099-NEC when you aren’t supposed to and how it can cause headaches when the IRS comes looking for money you never really earned but was misreported on your behalf. This is the flip-side for those of you who are the ones on the sending side.

Every year business owners face an issue.

It happens each January, without fail.

They have to decide if sending 1099-NEC forms is necessary.

In some cases it is.

In others, it definitely isn’t.

But there’s a catch these days.

What it basically comes down to is being charged for a service that isn’t necessary.

And by not necessary, I don’t mean “not something you have to do but helpful”.

No, I mean they may be charging you for something you shouldn’t be doing at all.

Something you shouldn’t be doing under any circumstances.

On top of that, they may be doing damage to your reputation.

Or at the very least making people not want to work with you.

As an accountant myself, I’ve heard plenty of stories about it happening.

And the problem which stems from the issue of whether or not to file these forms is:

Being charged to file 1099-NEC forms that shouldn’t be filed AT ALL.

Rules For Filing A 1099-NEC

Some of you may know the rules about working with independent contractors and freelancers.

Some of you might not.

In short, when you work with people who are not employees, you need to report any yearly amounts paid in excess of $600.

This is only for business expenses, mind you–not when you pay for personal things from your business (which you shouldn’t be doing anyway).

That’s the basic rule.

You are required to file a 1099-NEC with the IRS and issue a copy to the contractor.

You’re required to send this information to the individuals and the IRS by January 31st (or the next business day if it falls on a weekend).

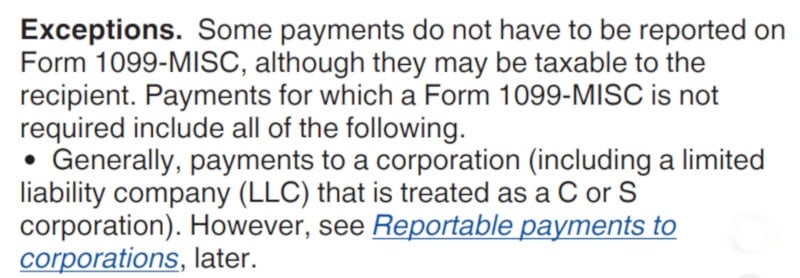

There are others–like you don’t issue a 1099-NEC to corporations for regular services.

But those really don’t have any bearing on this particular discussion.

Then there are the penalties if you mess up.

If you don’t file, fail to send the individuals their statements, or misrepresent the information you can face penalties based on the number of forms and how late they are filed.

Things have changed, however, when it comes to who you need to report payments to…

Why Your Accountant Shouldn’t Be Doing This Work

Many people find change difficult to accept.

It’s even worse when you’ve been doing something one way for what seems like forever only to be told that you have to change your ways going forward.

In this case, the change is in how to report payments to independent contractors.

It used to be that a small business (or any business for that matter) would have to file a 1099-NEC for anyone regardless of the payment type.

Of course, for most of that time, there wasn’t PayPal and only the largest of businesses could afford to accept payments via credit cards directly.

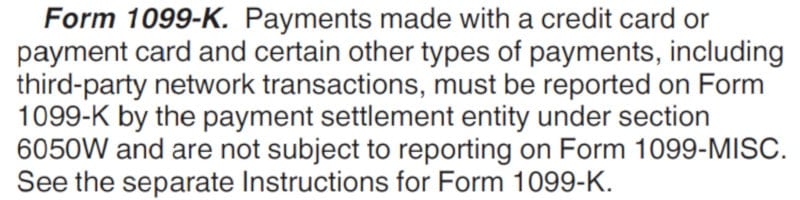

Back in 2011, the IRS changed the way that credit card and third-party payment processor transactions would be reported.

No longer will these types of payments be reported by the individual businesses on form 1099-NEC.

Instead, the processors will be issuing their own tax reporting form, called the 1099-K.

Why is this important?

(This is the aforementioned catch from the opening section!)

Because this change meant big savings for small businesses which stopped using cash (or checks) to pay their contractors.

They would no longer have to pay for the preparation and filing of 1099-NEC forms because it was no longer their responsibility.

But again, change is hard, and many accountants either couldn’t adapt to comply with the new rule or they outright ignored it.

This is where you’re paying for unnecessary work.

If you are paying all of your bills strictly by credit card or, say PayPal, you should UNDER NO CIRCUMSTANCES be issuing a 1099-NEC to any of the freelancers you hire.

Unfortunately, there are many reports of companies still doing exactly that.

They may simply not have told you what the rules were, to begin with, preying on your trust.

Some may even be using scare tactics–using the fines previously discussed–to scare you into paying them for a service they don’t belong doing.

Others still may simply (wrongly) believe that they are still doing things the “right way” since it’s what has always been done.

There are people even using a rationale similar to this:

We’re filing the 1099-NEC just in case because we can’t be sure the contractor will get a 1099-K”.

Regardless of the manner or reason, you shouldn’t be paying for this service if you paid someone via credit card, PayPal, or any other 3rd party processor that collects tax info for the purpose of issuing a 1099-K.

PERIOD!

You aren’t responsible for what your contractors do…you are only responsible to make sure your company does what is required of it.

Remember…you aren’t the tax police!

Corporations (Almost) Never Get A 1099-NEC

In the”Rules” section above I mentioned corporations.

This is because under most circumstances, corporations, whether C or S, are exempt from being issued a 1099-NEC.

This is regardless of payment method, meaning even if you pay cash to a corporation you don’t send them a 1099-NEC.

It also applies to other business structures electing to be taxed as a corporation (ie: the Single-Member LLC that files for S Corporation tax treatment).

Don’t believe me?

Is your accountant telling you otherwise?

Have a look for yourself (from page 3 of the 1099-NEC/MISC instructions):

Plain as day, right?

Oh yeah, those exceptions that are mentioned are pretty rare, although there is one very common one which we will get to in the very next section.

Trust me, I’ve had bosses who insisted on sending 1099s to everyone on behalf of clients–even corporations–and I would have to practically yell and shove the instructions in their face to make them relent.

Why?

Because it was wrong to both do the work that wasn’t required and especially to charge the clients for it!

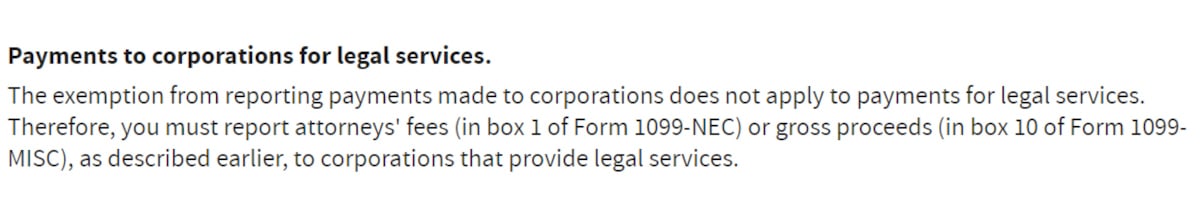

Sending Attorneys A 1099-NEC

Attorneys.

Lawyers.

Whatever term you use, they serve the same purpose for the 1099-NEC.

Payments to attorneys are always reported on a 1099-NEC regardless of business structure.

You send an attorney a 1099-NEC unless you paid them with a credit/debit card or PayPal-type service.

Business payments that is.

If you are paying for your attorney’s guidance and expertise on personal matters, then you don’t send a 1099-NEC.

What if you happened to pay for those personal services through your business?

Change your accounting for it from “Legal Fees” or “Legal & Professional” or whatever you named the category to “Distributions” or “Draw”.

You shouldn’t be paying for personal expenses with business money anyway.

Instead, you should pay yourself, then spend the money.

Yes, it’s confusing.

All you have to remember is:

- Attorney always = 1099-NEC when paying cash/check–the business structure means nothing in this situation.

- Attorney never = 1099-NEC when paying with debit/credit/PayPal/similar

PAY ATTENTION TO THIS PART BECAUSE IT IS A LITTLE DIFFERENT THAN OTHER TYPES OF PAYMENTS YOU REPORT ON THIS FORM.

In case you are wondering if you send the 1099-NEC or the old 1099-MISC for attorneys, here is the answer:

Cash Transfers: You Send A 1099-NEC

With the rise in the number of cash-transfer services, it’s important to take note that none of these systems count as “3rd party processors”.

That means all transactions done using these platforms require a 1099-to be filed.

These are simply “money transfer services” and not actual merchant services account.

Services like:

- Zelle

- Venmo

- Plastiq

- even bank Bill Pay

There is a huge difference in that money transfer services are supposed to be for personal use, whereas merchant services are for business payments.

If you aren’t giving your tax info to a system, then it is not going to send your partners a 1099-K, which in turn means you must complete a 1099-NEC for all payments made to those who qualify!

Don’t be fooled by services that allow you to fund your account with a credit card, however.

You are still going to be required to file a 1099-NEC for anyone you pay using that method because the transfer service still isn’t a 1099-K provider.

They send the money from their own account and recoup it plus a fee by charging your card so you really aren’t paying those people via credit card.

HOWEVER…

ACH transactions sent using actual 3rd party payment processors such as PayPal, Stripe, or other merchant services systems are exempt from reporting on a 1099-NEC!

Why?

Because even though those payments are being sent from your bank account to your contractor’s bank account, it is being done so via the same clearinghouse system that the credit and debit card transactions are done with.

This means all of the transactions are reported on the 1099-K that the processor files on your partners’ behalf (if they qualify).

Special Word On Transfer Apps & 1099-NECs

Venmo recently added the ability to use a credit card as a funding source.

Don’t let this confuse you…it doesn’t exempt you from filing a form 1099-MISCs for contractors to whom you send Venmo payments funded from a credit card.

Venmo itself is not a service that provides 1099-NEC or the 1099-K on anyone’s behalf on individual accounts.

Clarification: Venmo does have merchant accounts that qualify for the 1099-K but it’s specifically for businesses that submitted tax info.

Most people are using Venmo with their personal accounts to conduct business so you need to check with those people you pay with Venmo, but the overwhelming majority I’ve worked with use personal Venmo accounts and therefore require a 1099-NEC to be sent.

Neither is Cash App.

Even if you use a credit card to transfer money, all you are doing is funding your own account with cash from the card.

Then the cash is transferred to the recipient’s account.

This means that as long as you use these apps to send money, regardless of the source of the funds, you are still responsible to send the 1099-NEC to anyone you pay in excess of $600 in a calendar year who is not using a “business” account!

The same holds true for any of the other services which let you fund an account with a credit card but send the cash to the other person’s bank account.

It’s a very confusing issue because none of these companies make giving clear guidelines a priority on their sites.

Some, like Square’s Cash App, don’t even have a way for someone like me–a non-user accountant seeking clarification–to access support (you have to have an account or do an end-around and contact square first!)

The problem arising from this is that businesses are allowed to operate on these systems so…

You will need to ask anyone you send money to if they have a business or personal account!

Then based on that info, you will know whether or not to send a 1099-NEC.

Frustrating, I know, but that’s what we have to deal with these days?

PayPal Friends & Family

Very quickly:

You should not be sending contractor payments via PayPal’s Friends & Family option.

That is specifically designed to send–you guessed it!–friends and family money.

Money to reimburse them for your half of dinner.

Or a gift you both went in on together.

PayPal doesn’t recognize these payments as reportable on the 1099-K so if you pay a contractor with this option, you will have to send them a 1099-NEC.

And the contractor may even have their account closed for misusing the system or at the very least be told they have to convert it to a business account.

This Is Also Pissing Off Your Partners

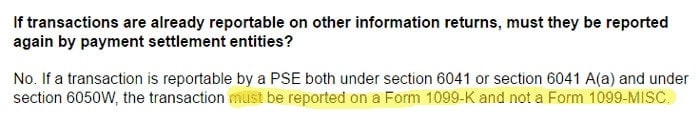

Remember how I said that the credit card or payment processor is responsible for reporting the 1099-K these days?

If you are still filing a 1099-NEC on your partner contractors’ behalves, then you reporting duplicate income.

When you report duplicate income, the IRS looks at their income tax returns and sees only part of that being reported.

Then, the IRS goes to your partners looking for the rest of the income that was reported under their tax ID, even though there isn’t any.

What that does is create headaches for your partners because they now have to spend time putting together reports showing that the money you reported is the same as what was reported by the processor and that their tax returns weren’t filed incorrectly.

This leads to lots of wasted time that could’ve been spent making money.

Or, if they have to pay their accountant to do the work, then you are costing them unnecessary spending.

And that my friends, pisses people off!

Do you really want to make life harder for people you have to work closely with and whom you rely on to do so many tasks for your business?

Get Your Accounting Straight

Look, I know that you may not have a clue about payroll tax rules or even what the hell a 1099-of-any-kind is.

But isn’t that why you pay a tax accountant or the people you run payroll with in the first place.

If you want to get all of this cleared up, the steps are simple:

- Ask your accountant why they prepared and charged you for preparing these forms

- If they can’t come up with a clearly defined and reasonable answer, fire them and hire an accountant that knows WTF they’re doing.

See, 2 steps are all it takes.

Oh, and please send your apologies to your contractors and let them know that you were not behind it and that you’re sorry they had to go through it.

You may also want to look into a malpractice suit against your old/current accountant since the instructions are crystal clear on this mess.

Update

I’ve received 2 emails already who have received 1099-NEC forms when they shouldn’t have and one of the people tried contacting the business which sent it. This is the response:

You use the Bluehost 1099-misc on your tax return and the paypal 1099-k is just for reference. You do not put the 1099-k on your tax return. https://www.irs.gov/uac/general-faqs-on-new-payment-card-reporting-requirements

You know what’s funny (or sad? or stupid?) about this response?

The link they provided is a F.A.Q. about reporting requirements for payment processors and it says the same thing that the 1099-NEC instructions state:

So, no matter what you reference, the answer is simple:

ANYTHING REPORTED ON A 1099-K DOES NOT GET REPORTED ON A 1099-MISC!!

Your Turn

If you happen to have fallen into this trap, leave a comment and let everyone know if you questioned your accountant/payroll processor about it and what their response was! And if you are on the receiving end of this debacle of a situation, tell us all too!

Dear Eric,

Do I understand correctly that now (Jan 2021) Venmo is considered a payment processor and does issue 1099-K forms through their owner PayPal but only for the business accounts?

https://help.venmo.com/hc/en-us/articles/360044347033-Business-Profiles-Tax-FAQ

Please advise and thank you in advance.

Hi Tatiana.

If you have a Venmo business account you count for the 1099-K form and not a 1099-NEC. Its an important distinction to make because the majority of people who use the platform do not have business accounts but it’s always best to double-check if you are the sender or to let people know if you are the recipient of Venmo payments.

Thank you for your prompt reply, Eric!

Thank you for this article! It is helping a lot right now. One question: You said payments to attorneys will always go on the 1099-MISC, however, I’m reading that proceeds from a settlement would go on the 1099-MISC, but regular attorney fees should be reported on the 1099-NEC. Which is correct?

p.s. I was going to read through the comments to see if this question was answered, but I’m at work and can’t go through them all.

Hi Brittany!

You report the attorney payments on the 1099-NEC, which is for non-employee payments and different than settlements for attorney services which is the 1099-MISC (box 10).

Shouldn’t payment to attorney use form 1099-MISC box 10 instead of 1099-NEC?

Thank you!

Hello Merry.

No, payments to an attorney for services rendered in the course of business are reported on form 1099-NEC just like other contractors. If you follow this link you will be taken to the instruction page directly to the section which states this.

Hope this helped!

Hello Eric,

I *think* I have read all of the comments and responses but I have an issue that I do not believe has been addressed. What happens if I pay Vendor ABC $300 through Stripe and $300 by check?

Will Stripe issue 1099-K forms for $300? What do I do about the $300 check payment? Is it wrong to combine both payments into one $600 1099-NEC form? Thanks!

Hey Keith.

You have to look at the different payment methods individually. If you didn’t pay in excess of $600 using cash/check then you don’t send a 1099-NEC.

Hi Eric, So is there indeed a loophole? If I pay someone $300 via check, $300 via Paypal, and $300 via Stripe, then I am not responsible for creating any 1099s? Will the IRS not consider that I have paid this vendor $900 in total? Thanks!

No, no loophole Keith.

The reason being is that it’s not your job or mine to be the tax police. If we pay someone an amount via a specific method that requires us to file a 1099-NEC then we do so. If not, we don’t.

That is our only responsibility–to file what we are required to file and not to worry about whether the contractor will qualify for a 1099-K or even if they will report all of their income.

We just have to worry about doing the right thing based on what we are supposed to do (and to not do what we aren’t supposed to do).

Hey Eric! I own an LLC taxed as a C Corp (but let’s pretend that’s not true). The company sells detail supplies and chemicals to car dealers and detailers. We sell products…not services. A ton of the dealers we are working with are sending us 1099-misc and I even got a 1099-NEC. Am I correct in my understanding that I wouldn’t get one because I sell products not services besides the fact that we are taxed as La C corp?

Hello Regina 🙂

You are correct, corporations (including LLCs treated as corps) do not get 1099s except for:

There is also a specific paragraph in the instructions for 1099-MISC/NEC under “Exemptions”:

This has no real effect on the Corporation taxes vs being taxed as a sole proprietor, but you can contact these people and advise them of these facts under the guise of “looking out for them” and saving them time and money if they are doing this for more than just your business.

Here is the link to that section: https://www.irs.gov/instructions/i1099mec#en_US_2022_publink100044508